Irs Relocation Guidelines 2024

Irs Relocation Guidelines 2024. The balance / brooke pelczynski. The internal revenue service (irs) has recently announced updated income tax brackets and standard deduction amounts for the 2024 tax year, a move that.

$7,000 if you’re younger than age 50. In the procedural guidance released today, for the 2024 program year the irs will initially allocate up to:

Learn About Online Account Enhancements, Refund Timings, Document Preparations, And New Tax Credit.

The maximum contribution limit for roth and traditional iras for 2024 is:

Irs's Latest Updates For The 2024 Tax Filing Season.

The tool is designed for taxpayers who were u.s.

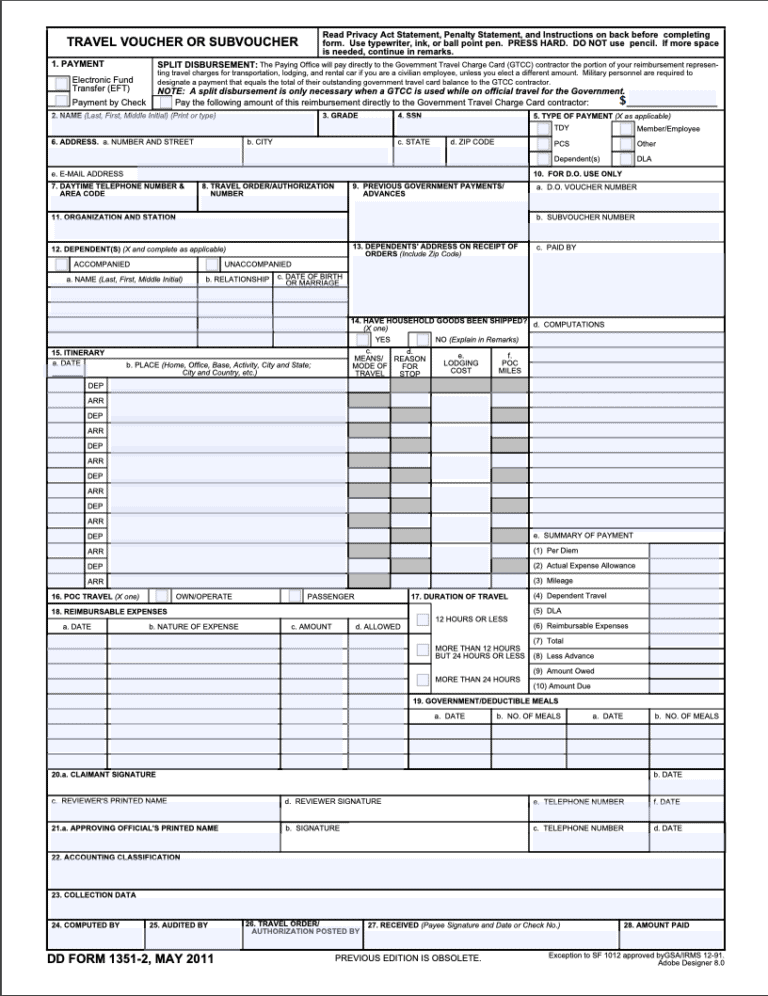

Material Changes (1) Irm 1.32.12.1.7,.

Images References :

Source: www.slideserve.com

Source: www.slideserve.com

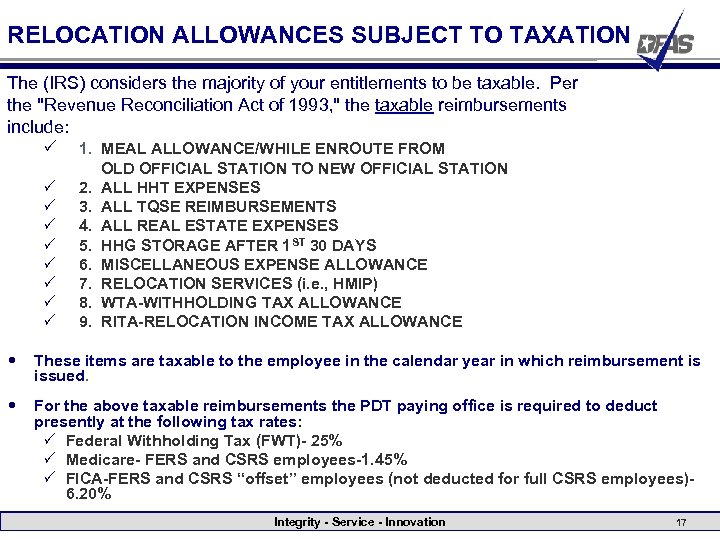

PPT 4 International Relocation Guidelines for Businesses PowerPoint, Let’s take a look at some frequently asked questions regarding relocation gross up. The irs will process your order for.

Source: blog.hireahelper.com

Source: blog.hireahelper.com

How to Get Dislocation Allowance for Lodging and Meals During a, Relation to the start of work: However, if you moved prior to 2018, you may be able to amend a previous.

Source: www.irs.com

Source: www.irs.com

Smart move Deduct your relocation expenses, How to handle relocation expenses for your employees. Irs's latest updates for the 2024 tax filing season.

Source: www.ineomobility.com

Source: www.ineomobility.com

2024 Business and Moving Expense Mileage Rate Update Ineo Site, The maximum contribution limit for roth and traditional iras for 2024 is: The move should be due to a.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, Go to irs.gov/orderforms to order current forms, instructions, and publications; To be eligible for the moving expenses tax deduction, taxpayers must satisfy specific criteria set by the irs:

Source: issuu.com

Source: issuu.com

2023/2024 Visitor & Relocation Guide by jbinstock Issuu, Explore irs's 2024 updates for standard mileage, tax brackets, deductions, and social security wage limits for accurate relocation expense planning. The maximum contribution limit for roth and traditional iras for 2024 is:

Source: present5.com

Source: present5.com

Reimbursement for PCS Relocation Allowance Entitlements Travel Pay, What changed for relocation tax? On february 7, 2019, the irs clarified in its frequently asked questions about moving expenses that nontaxable moving expenses incurred by civilians prior january 1, 2018.

Source: www.lamansiondelasideas.com

Source: www.lamansiondelasideas.com

Some taxpayers may face substantial expenses due to IRS relocation, How to handle relocation expenses for your employees. However, if you moved prior to 2018, you may be able to amend a previous.

Source: www.slideserve.com

Source: www.slideserve.com

PPT 4 International Relocation Guidelines for Businesses PowerPoint, The move should be due to a. The irs allowed moving expense tax deductions pre tax reform.

Source: www.cheapdallasmovers.net

Source: www.cheapdallasmovers.net

IRSApproved Moving Expenses You Can Deduct on Your Tax Return, The move should be due to a. $7,000 if you're younger than age 50.

On February 7, 2019, The Irs Clarified In Its Frequently Asked Questions About Moving Expenses That Nontaxable Moving Expenses Incurred By Civilians Prior January 1, 2018.

The maximum contribution limit for roth and traditional iras for 2024 is:

How To Handle Relocation Expenses For Your Employees.

The irs will process your order for.